The Big Apartment Shortage

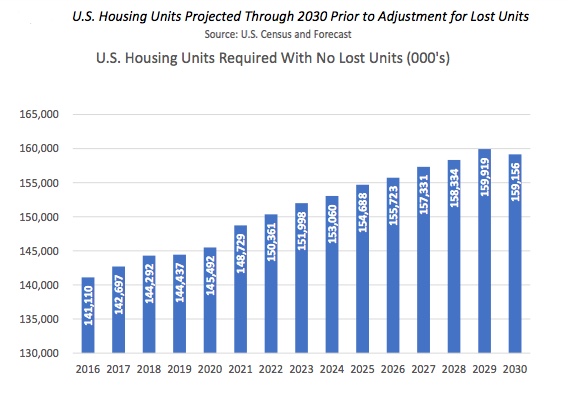

According to the National Apartment Association (NAA) America needs to build more than 4.6 million new apartment homes at a variety of price points by 2030. The 4.6 million projection is low because it does not factor in current supply-demand imbalances- 11.7 million existing apartment that need renovation by 2030 and the loss of 75,000+ apartments from obsolescence. Shortage is likely to worsen in the future due to 51% of the nation’s apartments being built pre 1980. Without resources dedicated to rehabilitation, more apartments will leave the available pool.

The collapse of U.S. financial markets in 2008 practically shut down new apartment construction for several years. The creation of 325,000 new apartments each year is required for the US to meet the projected demand. The last time the apartment industry built 325+ apartments was 1989. The industry built an average of 244,000 new apartments from 2012-2016.

Multifamily Residence Demand

Renting has reached an all-time high. With a population of 39 million, 1-in-8 US residents are living in an apartment. The U.S. is undergoing a fundamental change in housing dynamics as people are eschewing the typical suburban house for rental housing.

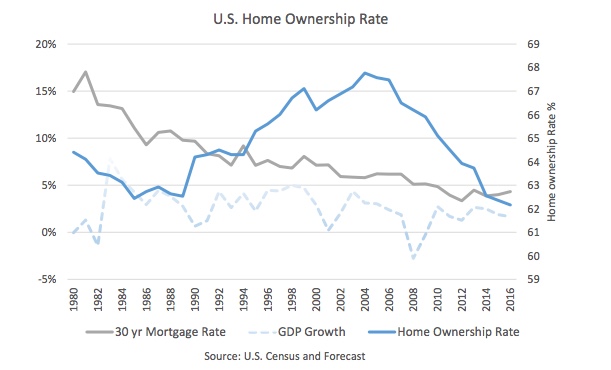

With a growing population of 75 million echo-boomers (young adults ages 18 to 34) an age group likely to rent has now become the largest generational demographic group in the U.S. The sheer number of echo boomers combined with long/short term social trends has a profound impact on apartment demand. Couples are marrying approximately five year later than they did in 1980. Echo boomers homeownership rate is lower, with 35% percent owners compared to 41% percent of young adults in 1981(U.S. Census Bureau). Although the economy has been in a period of expansion, high unemployment rates from the past 10 years, are just now trickling down to young adults. Echo Boomers are also experiencing the growing burden of student debt which hinders the ability to purchase homes.

As housing dynamics change renting has began to appeal to another generation. Once the nation’s largest demographic group, baby- boomers (those born between 1946 and 1964) are choosing to rent. Between 2006-2016, 58% of the increase in renter households were baby boomers.

Construction Constraints

Apartment development has become costlier and more time-consuming. Over the last three decades, regulatory barriers to apartment development have increased significantly.

- Outdated land use restrictions, environmental site assessments, permitting requirements, zoning laws, parking requirements, and more, discourage construction and increase the cost. The whole process can take 2- 10 years and require an upfront capital of $1 million or more before construction breaks ground

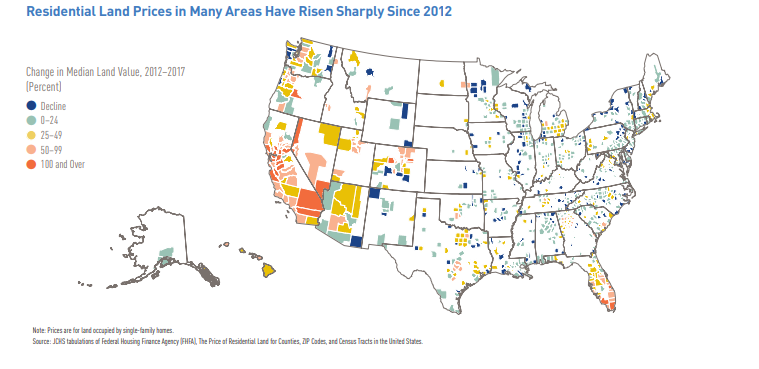

- Available land competition skyrockets cost. Labor costs have increased due to a shortage of skilled workers. The previous recession left many workers wary of the construction industry and they have yet to return.

- Localities can impose an assortment of fees on new apartments; inspection fees, impact fees, property taxes. Local rent control and zoning mandates further discourage apartment construction